Contents:

Statement of condition; statement of financial condition; statement of financial position. Participating lenders of the partner network are federally-insured, federal and state-chartered financial institutions or otherwise lenders with the requisite licensing to provide non-discriminatory credit . Regardless of the budgeting approach your organization adopts, it requires big data to ensure accuracy, timely execution, and of course, monitoring. There are a variety of ways in which management, and analysts, view retained earnings. Management will regularly review retained earnings and make a decision based on the goals and objectives they have established. Before Statement of Retained Earnings is created, an Income Statement should have been created first.

In that role, Ryan co-authored the Student https://1investing.in/an Ranger blog in partnership with U.S. News & World Report, as well as wrote and edited content about education financing and financial literacy for multiple online properties, e-courses and more. Ryan also previously oversaw the production of life science journals as a managing editor for publisher Cell Press. Billie Anne has been a bookkeeper since before the turn of the century. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Partner and a Mastery Level Certified Profit First Professional. She is also a guide for the Profit First Professionals organization.

bookkeeper definition payment of dividends leads to cash outflow and is recorded in the books and accounts as net reductions. As the company loses ownership of its liquid assets in the form of cash dividends, it reduces the company’s asset value on the balance sheet, thereby impacting RE. Is not as widely discussed as the income statement, balance sheet, and statement of cash flows. However, the retained earnings statement is one of the most important things small businesses need to know about accounting.

What Are Retained Earnings in Accounting?

In this post we will cover retained earnings, how it is calculated, how it is used by management and some of its limitations. Dividends are a debit in the retained earnings account whether paid or not. There are businesses with more complex balance sheets that include more line items and numbers. Use LiveFlow to pull your Balance Sheet with Retained Earnings from QuickBooks into Google Sheets in real-time, you can create Live Reports with LiveFlow. Download LiveFlow from Google Workspace Marketplace or QuickBooks App Store to track your performance automatically.

- However, from a more cynical view, the growth in retained earnings could be interpreted as management struggling to find profitable investments and project opportunities worth pursuing.

- Level up your career with the world’s most recognized private equity investing program.

- Management should reinvest this back into the business operations, pay down debt, or distribute it to shareholders.

- Retained earnings represent a useful link between the income statement and the balance sheet, as they are recorded under shareholders’ equity, which connects the two statements.

It generally limits the use of the prior period adjustment to the correction of errors that occurred in earlier years. For various reasons, some firms appropriate part of their retained earnings . Working Capital (Current Assets – Current Liabilities) is a liquidity ratio that measures a firm’s ability to meet current obligations. Revenue—value of goods and services the organization sold or provided.

What is the Statement of Retained Earnings?

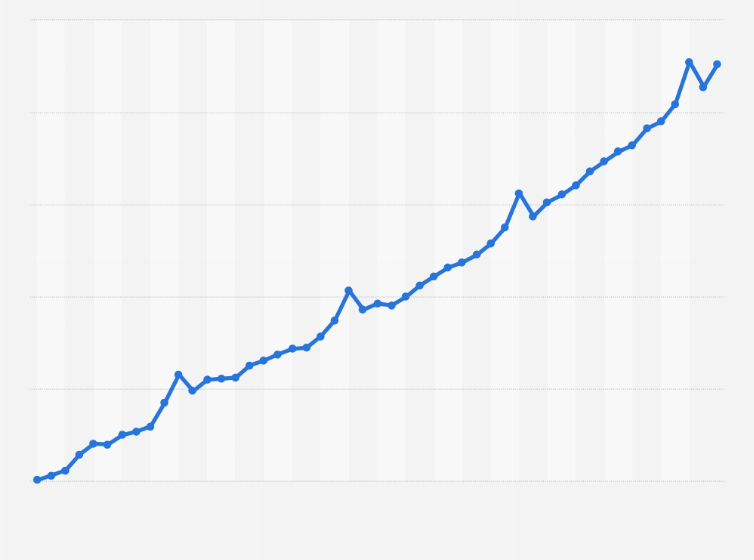

From there, you will be able to easily create a statement of retained earnings from the data on your reports. As a broad generalization, if the retained earnings balance is gradually accumulating in size, this demonstrates a track record of profitability . On the balance sheet, the “Retained Earnings” line item can be found within the shareholders’ equity section. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business, to learn more about the different types of financial statements for your business.

Draft decisions of the Annual General Meeting of Shareholders to be … – GlobeNewswire

Draft decisions of the Annual General Meeting of Shareholders to be ….

Posted: Thu, 06 Apr 2023 13:00:00 GMT [source]

The first line on an income statement will typically be “Gross Sales” or “Gross Income,” the total amount of money earned from sales of goods or services. CollectEarly™ is a loan program managed by FINSYNC Servicing, LLC for business credit extended by participating lenders to borrowers for the purpose of cash advances on outstanding payment requests or invoices. FINSYNC Servicing, LLC services the cash advances on invoices, which are short-term loans, by collecting on future payments as a payments network operator on behalf of participating borrowers and lenders. FINSYNC is the only all-in-one platform that helps businesses get all their finances in sync, centralize control of cash flow, and get in sync with the right financial professional at the right time. Centralize your accounting, payroll, and cash flow management on our all-in-one platform.

Best practices & recommendations for your remote finance team

This analysis will help you accurately forecast your future financials while also providing insights regarding your cash position. A company can dive into the retained earnings to pay dividends to the shareholders when it cannot generate enough profit. Let us take the example of ZXC Inc. to illustrate the concept of retained earnings.

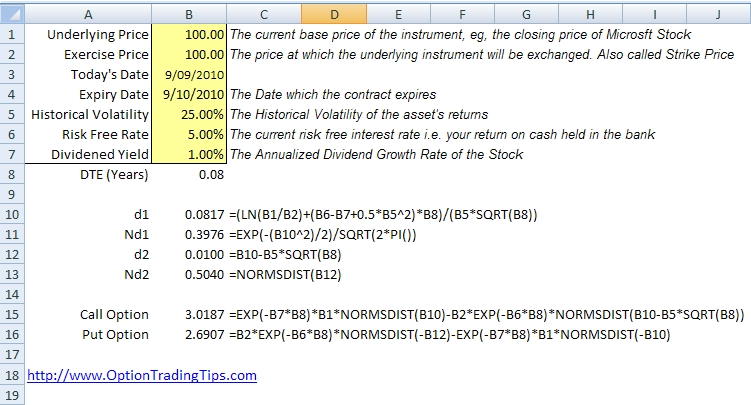

The Retained Earnings account can be negative due to large, cumulative net losses. The steps below show how to calculate retained earnings in Google Sheets when the company has reported negative net income or net losses. Gather the necessary data from the balance sheet and income statement. Revenues represent how much money the company took in over a specific period, such as monthly or quarterly.

What Does it Mean to Have Negative Retained Earnings?

Previous illustrations showed how retained earnings increases and decreases in response to events that impact income. A company’s overall net income will cause retained earnings to increase, and a net loss will result in a decrease. You can track your company’s retained earnings by reviewing its financial statements. This information will be listed on the balance sheet under the heading “Retained Earnings.” The income statement for Cheesy Chuck’s shows the business had Net Income of $5,800 for the month ended June 30.

- Although they’re shareholders, they’re a few steps removed from the business.

- The company can use this amount for repaying its debts, or reinvesting them in its operations for expansion and diversification.

- But this does have the effect of diluting the price per share and is the reverse of a stock buyback.

- If accountants and company management fail to do so, they may incur heavy penalties.

- If you own a very small business or are a sole proprietor, you can skip this step.

The statement also indicates that the company paid out dividends of $10,000 during the year. This is the amount of retained earnings that John had at the beginning of the accounting period. Retained earnings represent a crucial component of a company’s financial health, as they provide the resources needed to support growth and investment in the future.

Crash Course in Accounting and Financial Statement Analysis, Second Edition by Matan Feldman, Arkady Libman

Such items include sales revenue, cost of goods sold , depreciation, and necessaryoperating expenses. Over the same duration, its stock price rose by $84 ($112 – $28) per share. For an analyst, the absolute figure of retained earnings during a particular quarter or year may not provide any meaningful insight.

Micron Technology, Inc. Reports Results for the Second Quarter of … – Micron Investor Relations

Micron Technology, Inc. Reports Results for the Second Quarter of ….

Posted: Tue, 28 Mar 2023 07:00:00 GMT [source]

If over four months net income is $10 each month retained earnings will grow by $10 each month or $40 over the four month period. The retained earnings are the first and easiest source of capital without any additional cost of funding. The Statement of Retained Earnings shows the accumulated portion of a business’s Profits that are not distributed as Dividends to shareholders but instead are reserved for reinvestment back into the business. When you leave a comment on this article, please note that if approved, it will be publicly available and visible at the bottom of the article on this blog. For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. If a business is small or in the early stages of growth, you might think that using retained earnings in this way makes complete sense.

Incorrect Presentation of Stock Splits can impact a company’s retained earnings. If stock splits are not properly accounted for in the Statement of Retained Earnings, it can result in an incorrect presentation of the company’s financial position. Shareholders often view a company’s decision to retain earnings as a positive sign, as it suggests the company is confident in its prospects and is investing in its growth. This can lead to an increase in the stock price and can help to attract new investors. Add this retained earnings figure of $7,000 to the Q3 balance sheet in the retained earnings section under the equity section. Because of this, the retained earnings figure doesn’t necessarily communicate much about the business’ success in the here and now.

Dividends are the portion of the business’s profits that are distributed to the owners or shareholders. Let’s say that John paid out $10,000 in dividends during the accounting period. Finally, the statement of retained earnings is essential for tax purposes.

Firan Technology Group Corporation (“FTG”) Announces First Quarter 2023 Financial Results – Marketscreener.com

Firan Technology Group Corporation (“FTG”) Announces First Quarter 2023 Financial Results.

Posted: Wed, 12 Apr 2023 21:01:02 GMT [source]

Let’s say that John’s company earned $100,000 and incurred expenses of $70,000, which means that the company had a net income of $30,000. Retained Earnings represent a portion of the business’s Net Income not paid out as Dividends. This means that the money is placed into a ledger account until it is used for reinvestment into the company or to pay future Dividends.